Taxpayer’s Profile

New section 114A has been inserted under the Income Tax Ordinance, 2001 (the Ordinance) vide the Finance Act, 2020 which required mandatory filing and timely update of profile at FBR web portal by following persons: Every person applying for registration under section 181Every person deriving income chargeable to tax under the head “Income from business” Every person whose income is subject to final taxation any non-profit organization as defined in clause (36) of section 2Any trust or welfare institution; or any other person prescribed by the BoardThe profile must be complete and contain all required information which includes the following:

Bank accounts

Utility connections

Business premises including all manufacturing, storage or retail outlets operated or leased by the taxpayer

Types of businesses; and such other information as may be prescribed

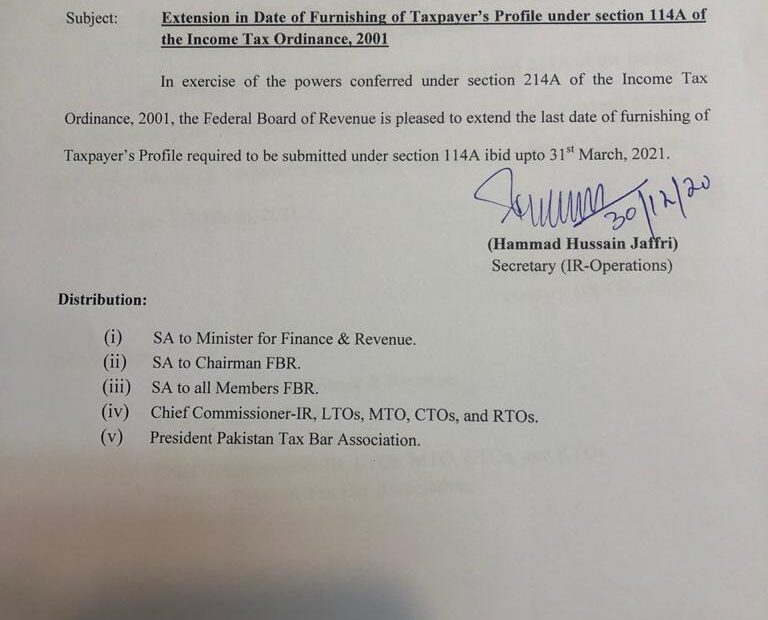

The above-mentioned persons who are already registered with FBR before 30th September 2020 are required to update their profile by 31st December 2020. Newly registered taxpayers are required to update their profile within 90 days of their registration with FBR. In case of profiles are not updated within the stipulated time, such non-filing or late filing of taxpayer’s profile shall lead to exclusion of name from Active Taxpayer List (ATL) in terms of section 182A of the Ordinance. Further, it also attracts a minimum penalty of Rs. 10,000 which will extendable to Rs. 2,500 per day of default. In order to avoid penalties and removal of name from ATL, you are required to timely update your profile at FBR Web portal.